Page 31 - EXPORT HYGIENE & BEAUTY

P. 31

ricerche di mercato

Vendita Volume / Purchase Volume market research

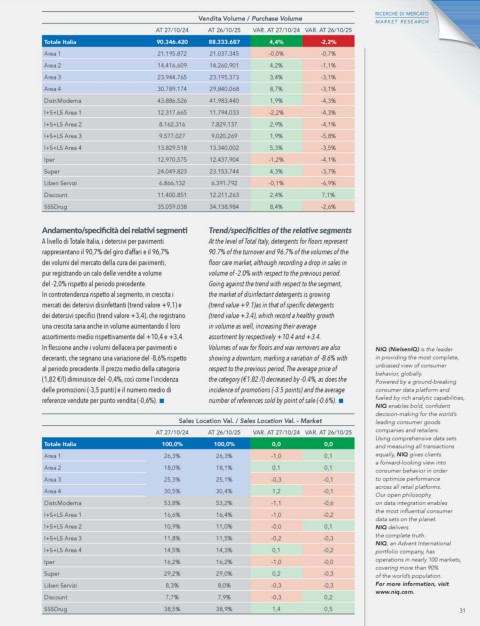

AT 27/10/24 AT 26/10/25 VAR. AT 27/10/24 VAR. AT 26/10/25

Totale Italia 90.346.420 88.333.687 4,4% -2,2%

Area 1 21.195.872 21.037.345 -0,0% -0,7%

Area 2 14.416.609 14.260.901 4,2% -1,1%

Area 3 23.944.765 23.195.373 3,4% -3,1%

Area 4 30.789.174 29.840.068 8,7% -3,1%

Distr.Moderna 43.886.526 41.983.440 1,9% -4,3%

I+S+LS Area 1 12.317.665 11.794.033 -2,2% -4,3%

I+S+LS Area 2 8.162.316 7.829.137 2,9% -4,1%

I+S+LS Area 3 9.577.027 9.020.269 1,9% -5,8%

I+S+LS Area 4 13.829.518 13.340.002 5,3% -3,5%

Iper 12.970.575 12.437.904 -1,2% -4,1%

Super 24.049.823 23.153.744 4,3% -3,7%

Liberi Servizi 6.866.132 6.391.792 -0,1% -6,9%

Discount 11.400.851 12.211.263 2,4% 7,1%

SSSDrug 35.059.038 34.138.984 8,4% -2,6%

Andamento/specificità dei relativi segmenti Trend/specificities of the relative segments

A livello di Totale Italia, i detersivi per pavimenti At the level of Total Italy, detergents for floors represent

rappresentano il 90,7% del giro d’affari e il 96,7% 90.7% of the turnover and 96.7% of the volumes of the

dei volumi del mercato della cura dei pavimenti, floor care market, although recording a drop in sales in

pur registrando un calo delle vendite a volume volume of -2.0% with respect to the previous period.

del -2,0% rispetto al periodo precedente. Going against the trend with respect to the segment,

In controtendenza rispetto al segmento, in crescita i the market of disinfectant detergents is growing

mercati dei detersivi disinfettanti (trend valore +9,1) e (trend value +9.1)as in that of specific detergents

dei detersivi specifici (trend valore +3,4), che registrano (trend value +3.4), which record a healthy growth

una crescita sana anche in volume aumentando il loro in volume as well, increasing their average

assortimento medio rispettivamente del +10,4 e +3,4. assortment by respectively +10.4 and +3.4.

In flessione anche i volumi dellacera per pavimenti e Volumes of wax for floors and wax removers are also NIQ (NielsenIQ) is the leader

deceranti, che segnano una variazione del -8,6% rispetto showing a downturn, marking a variation of -8.6% with in providing the most complete,

al periodo precedente. Il prezzo medio della categoria respect to the previous period. The average price of unbiased view of consumer

behavior, globally.

(1,82 €/l) diminuisce del -0,4%, così come l’incidenza the category (€1.82 /l) decreased by -0.4%, as does the Powered by a ground-breaking

delle promozioni (-3,5 punti) e il numero medio di incidence of promotions (-3.5 points) and the average consumer data platform and

fueled by rich analytic capabilities,

referenze vendute per punto vendita (-0,6%). number of references sold by point of sale (-0.6%).

NIQ enables bold, confident

decision-making for the world’s

Sales Location Val. / Sales Location Val. - Market leading consumer goods

companies and retailers.

AT 27/10/24 AT 26/10/25 VAR. AT 27/10/24 VAR. AT 26/10/25

Using comprehensive data sets

Totale Italia 100,0% 100,0% 0,0 0,0 and measuring all transactions

Area 1 26,3% 26,3% -1,0 0,1 equally, NIQ gives clients

a forward-looking view into

Area 2 18,0% 18,1% 0,1 0,1

consumer behavior in order

Area 3 25,3% 25,1% -0,3 -0,1 to optimize performance

across all retail platforms.

Area 4 30,5% 30,4% 1,2 -0,1

Our open philosophy

Distr.Moderna 53,8% 53,2% -1,1 -0,6 on data integration enables

the most influential consumer

I+S+LS Area 1 16,6% 16,4% -1,0 -0,2

data sets on the planet.

I+S+LS Area 2 10,9% 11,0% -0,0 0,1 NIQ delivers

the complete truth.

I+S+LS Area 3 11,8% 11,5% -0,2 -0,3

NIQ, an Advent International

I+S+LS Area 4 14,5% 14,3% 0,1 -0,2 portfolio company, has

Iper 16,2% 16,2% -1,0 -0,0 operations in nearly 100 markets,

covering more than 90%

Super 29,2% 29,0% 0,2 -0,3 of the world’s population.

Liberi Servizi 8,3% 8,0% -0,3 -0,3 For more information, visit

www.niq.com.

Discount 7,7% 7,9% -0,3 0,2

SSSDrug 38,5% 38,9% 1,4 0,5 31